Today marks our nine-month portfolio review. We will examine the performance from January 1st through September 30th, analyze the current portfolio composition, and detail the trades made during the quarter.

It’s worth remembering that all portfolio movements are consistently published in my notes, ensuring full transparency and an accurate track record. This project began on January 1, 2025, with an initial portfolio value of €50,000.

Performance

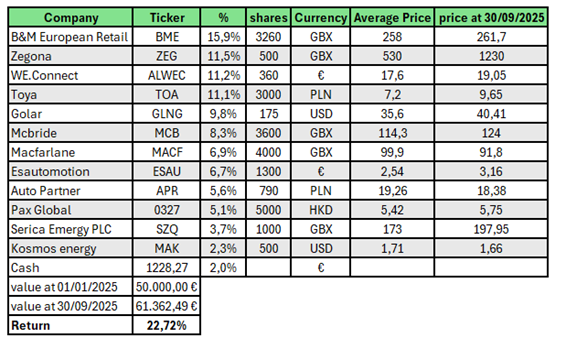

The performance has been more than satisfactory; we continue to add returns quarter after quarter. From January 1, 2025, to September 30, 2025, the return is 22.7%, outperforming the major indices.

Now, let’s dive into the composition and changes within the portfolio.

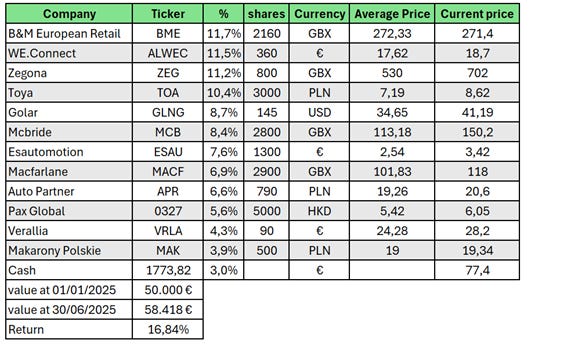

This is how the portfolio looked on June 30, 2025, with a year-to-date return of 16.5%.

This is what the portfolio looks like as of September 30, 2025.

Sales

Makarrony Polskie

The business remains cheap, and nothing special has happened to the business.

However, I chose to use the cash from this position to increase my holdings in companies with better returns on invested capital where I see greater potential. Specifically, I used the funds to increase positions in B&M, Macfarlane, and Golar.

Verallia

My decision to sell Verallia had two motivations. The first is like Makarrony: reallocating capital to opportunities with higher potential.

The second reason is that I overestimated Verallia’s earnings power, as the sector price deflation was stronger than expected. Nevertheless, thanks to the inherent margin of safety when buying, I managed to sell this position at a profit.

Nevertheless, thanks to buying with a safety margin, I managed to sell this position with profit. At current prices, Verallia may once again become interesting. Analysts’ estimates suggest it could trade below 10x earnings in the next year or two. I wouldn’t rule out buying back in if the price is right.

Zegona Communications

This has been the best-performing stock in the portfolio, delivering a return of 123.6% from an average cost of 550 GBX to the close of the quarter. I reduced the weighting for two main reasons:

Overweighting: Due to the massive appreciation, the position had become too large within the portfolio.

Reduced Potential: The upside potential has naturally decreased with the price climb.

Despite the reduction in potential, I have not sold the company completely due to rumors of a takeover bid by Telefónica, which is seeking to consolidate the sector in Spain.

Buys:

UK Small/ Buys (B&M, Macfarlane, McBride)

This companies—B&M, Macfarlane, and McBride—share a common theme: they are Small Caps trading on the UK market, a segment currently unloved by Mr. Market.

B&M: The stock pulled back after reporting slightly lower-than-expected—though still positive—growth. I took advantage of this decline to increase my position, making it my largest holding. The recent significant open-market purchases by the CEO are also a strong positive signal.

Macfarlane: While the latest results may not have thrilled the market, I believe the thesis remains intact. Macfarlane is well-positioned to continue consolidating the market.

McBride: Similar to the two above, I increased my position to capitalize on the price decline.

When Mr. Market gives me an opportunity, I intend to take it.

Other buys:

I increased my position slightly in Golar to take advantage of the market volatility.

Serica Energy and Kosmos Energy are new positions. Although commodities are not where I feel most comfortable, I believe both companies are deeply undervalued. My timing for Serica was fortunate, as the stock appreciated by over 14% the day after my purchase.

Summary

Overall, I am very pleased with the 22.7% performance year-to-date. While I am currently struggling to find new, compelling ideas, I believe the current portfolio composition still holds significant potential.

Disclaimer: This content is for informational and educational purposes only and is not investment advice. You are solely responsible for your investment decisions.

Carlos como ves de cara a futuro B&M? La llevo en positivo pero acaba de despegar. Algún catalizador a la vista?