Publication schedule.

Before I dive into this week’s company news, I want to share a quick update on how I’ll be organizing the newsletter going forward.

To deliver a better experience and more consistent, high-value analysis, I am establishing a fixed monthly publication schedule.

· Monthly news on portfolio companies (1st Friday of the month)

· Monthly Value Screener (New section! - 2nd Friday)

· Company analysis/Deep dive (3rd Friday). My primary goal remains quality over quantity. If I can’t come up with any new ideas, there may not be any new analysis that month. In that case, I will probably update an old thesis.

· Portfolio Update (Quarterly): I will publish the full portfolio breakdown and performance review within the first 7 days of every new quarter.

· Buys & Sells (Daily on the Substack Notes)

Now, let’s get into the monthly news

B&M European Value Retail (BME) – Insider Buying

The company’s new CEO has once again been buying shares on the open market. Over the last month, the CEO purchased shares totaling £587,651.18.

As the Peter Lynch famously said:

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

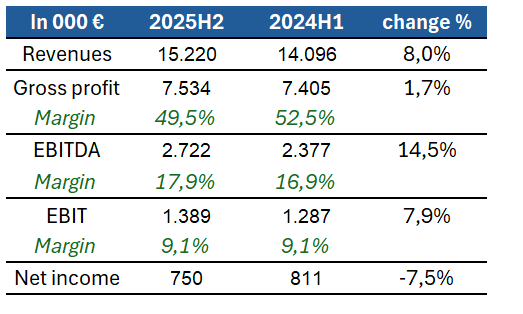

Esautomotion H1 2025 Results —Strong growth in Q2

Revenues: Strong Momentum from New Clients

Revenues in H1 2025 grew 8% compared to H1 2024. The most interesting aspect is the quarterly performance:

Q2 2025 revenues surged by 24% compared to Q2 2024. This increase appears to be due to the beginning of a market recovery during H1, with machine tool orders growing by 13.9% compared to the previous year (UCIMU-Sistemi per Produrre data) and the addition of new customers.

Due to the nature of the business (which requires time for implementation and testing before orders are recognized as revenue), the impact of these new clients is expected to be even greater in the second half .

Gross margin: Decline due to an unusually high margin in H1 2024.

EBITDA: Increase in margin reflecting the company’s operational leverage.

EBIT margin: remained virtually stable due to an increase in Depreciation, impairment losses and provisions line item. This increase is mainly related to an impairment provision on receivables.

Net Profit stood at €0.75 million, a 7.5% decrease due to a rise in financial costs.

Cash flow:

Cash from Operations : Decreased significantly to €1.03 million (vs. €2.6 million in H1 2024). This drop is because working capital had a negative effect in the period, contrasting with the positive effect it had last year.

Free Cash Flow : Was near zero. Eliminating the negative impact of working capital, the adjusted FCF would have been €1.46 million.

Balance Sheet

The company maintains an excellent Financial Position with net cash of €3.365 million. Excluding leases worth €1.8 million, the adjusted net cash position amounts to €5.59 million. This is significant for a company with a market capitalization of approximately €38.25 million.

Conclusion and Outlook

The results may not appear promising at first, they are cause for optimism.

The market may not have fully recovered yet, but I expect a stronger second half of the year. Growth from new customers, which will have a greater impact in the second half of the year. Assuming the next few quarters are similar to Q2, the company will exceed 30 million, growing by more than 15%. Thanks to operational leverage, profit growth will be even higher.

Esautomotion is a cyclical company but with competitive advantages in terms of switching costs, as evidenced by the fact that it has not lost a single customer.

Its main investment is working capital, and when this returns to normal levels, plus the effect of operating leverage when the market recovers, should translate into a strong cash generation for a company that currently has 15% of its capitalization in cash.

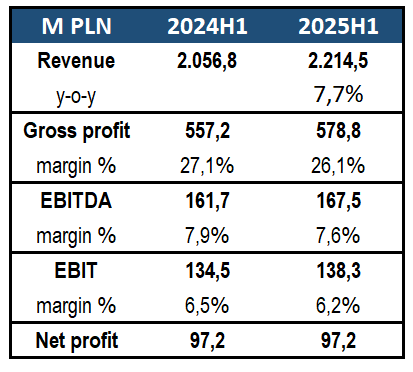

Auto Partner S.A. (APR) – H1 2025 Results Analysis. Growth: Slower than We’re Used To

Growth: Slower than We’re Used To

Auto Partner reported a 7.7% increase in revenues, reaching 2.2 Billion PLN for the first half of the year.

The growth has been stronger internationally, with foreign sales up 8.7% compared to 6.6% in Poland. International sales now account for 51% of total revenue.

Margins: Normalization

The largest hit came from the Gross Margin. Management attributes this primarily to the faster growth of international sales, which typically carry lower gross margins but higher operating margins.

While international growth certainly played a role, the reality is that the company benefited from unusually high gross margins during the pandemic years (2020-2022). We are now seeing a normalization trend.

The good news is that management expects future gross margins to settle above pre-pandemic levels, though not as high as the recent peak years. In the medium to long term, I expect this to be close to 27%, depending also on fluctuations in the value of the PLN.

Despite the margin pressure and the fact that the company is incurring costs (but generating no revenue) from a new distribution center, EBITDA and EBIT margins declined less than the gross margin. This stability shows the company’s focus on cost control and maintaining profitability during a period of slower growth. Consequently, Net Income remained virtually flat compared to last year.

Cash Flow

Cash generation was strong, with Free Cash Flow hitting 185.5 Million PLN, largely helped by an 87.7M PLN contribution from Working Capital.

Balance Sheet

Auto Partner remains in a strong financial position. Annualizing the current EBITDA would result in a Net Debt/EBITDA ratio of around 0.4x.

Capacity Expansion: The Long-Term Play

Management is making key moves that point to future growth:

German Warehouse: In August, the company opened a small warehouse outside of Poland, in Germany. This is an experimental opening, and based on its performance, they will study expanding the concept.

Zgorzelec Hub: The new, highly automated logistics hub in Zgorzelec is expected to begin operations in late 2025 or early 2026. This project has been a source of margin pressure up to now. Once operational, it is expected to boost APR competitiveness in exports to Western Europe by drastically cutting delivery times.

Conclusion

Auto Partner’s stock has had a rough year due to the growth slowdown. The sector itself, while defensive, is facing headwinds, including price deflation from manufacturers.

I personally view this as a transitional year. Growth is temporarily slower as the company prepares for the launch of the Zgorzelec center. I think that the new hub will enable the company to resume high growth rates of 15-20% over the next couple of years. Combined with the German warehouse, this could mark the beginning several years of growth into Western Europe.

The period of slower growth also had some positive effects, helping APR to digest years of rapid expansion during which working capital was a major drag on cash flow. Both last year (12.6% growth) and this year’s 7% growth have allowed the business to generate the necessary cash to fund new investments.

Valuation : Reasonable for both scenarios

Assuming the company generates similar earnings to last year, the stock trades at P/E ratio of around 11x.

Even if the growth rate were to settle at the high single-digit levels we see now, the valuation still doesn’t look excessive for a well-managed, defensive business.

My personal view is that the company will return to higher growth rates (15-20%) once the distribution center is operational. Furthermore, net income should grow faster than revenue as margins are currently depressed by sector deflation, higher personnel costs, and non-operational expenses from the Zgorzelec project. If APR recovers its historical growth pace next year, a market re-rating is likely, but with the growth of the company, it is not necessary.